Who Gets to Come Back?

Not all departing companies will be welcomed back. The Government Commission for Control over Foreign Investments in the Russian Federation will review applications, prioritizing businesses that operate in sectors where local alternatives remain weak.

Decisions will be made case by case, with no blanket approvals. A major concern for policymakers is shielding domestic companies that expanded into markets abandoned by foreign firms.

Strict Rules for Re-entry

Foreign companies hoping to resume operations in Russia will need to comply with a set of conditions currently being drafted by the Russian Ministry of Finance. Key proposals include:

- Local production mandates: Firms may be required to shift a significant portion of their manufacturing to Russia within a fixed period.

- Technology transfers: Some businesses could be asked to establish R&D centers or share proprietary know-how with Russian partners.

- Joint ventures: Returning companies might need to form partnerships with current Russian shareholders of their former subsidiaries or with systemically important enterprises, particularly in sectors deemed critical for import substitution.

The government has also signaled that companies with unpaid taxes, unresolved salary disputes, or ties to entities supporting Ukraine will face additional scrutiny — or outright bans.

New Rules for Repurchasing Sold Assets

Restrictions on foreign investors seeking to repurchase assets sold during their exit are tightening as well. Under proposed amendments to the Foreign Investment Law (not published yet), transactions could be blocked entirely for companies operating in socially or economically critical sectors (e.g. food production, retail, energy and industrial manufacturing).

Key Provisions of the Draft Law:

- Sector-Specific Veto Power: Regulatory authorities overseeing each industry would decide whether to permit buyback deals.

- Retroactive Application: Existing buyback options (*including “1-ruble” deals) may be invalidated if deemed against national interests.

- Termination Clauses: Russian buyers could unilaterally cancel options if the foreign seller is based in an “unfriendly” country, shares were sold between February 2022 – March 2025, or the buyback price is below market value, or the option period exceeds 2 years.

In a related move, the President of Russia has also ordered the compilation by 15 May 2025 of a list of companies from “unfriendly” countries that ceased operations in Russia in 2022. The list shall include details of the circumstances surrounding their departure, as well as information on their shareholders and beneficial owners.

Considering a Return to the Russian Market?

The final requirements are expected in the coming weeks, with enforcement likely starting mid-2025. Businesses exploring a return should prepare for:

- Stricter localization demands than before 2022.

- Possible joint-venture obligations, especially in tech and manufacturing.

- Asset repurchase limits if they previously sold Russian subsidiaries.

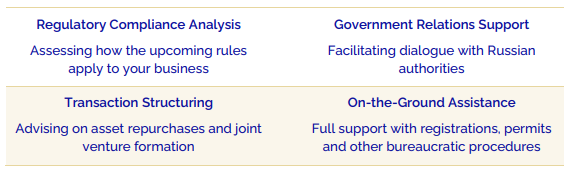

If your company is evaluating the possibility of resuming operations in Russia, our team can provide expert guidance on navigating the new requirements. We may offer:

Contact Solstico Legal today to discuss your specific situation and develop a tailored re-entry strategy. Our deep understanding of the evolving Russian business environment can help you make informed decisions while minimizing risks.